Understanding Your Dental Insurance

A comprehensive explanation by Dr. Alex W Broesder

Introduction

Navigating dental insurance can be perplexing for many. The intricacies of insurance policies and the sometimes limited information from insurers can make it challenging for patients to fully understand their benefits. This section aims to demystify the process and help you work effectively with your dental insurance to maximize the benefits you are entitled to.

What is Dental Insurance?

Dental insurance is a contractual agreement between your employer (or you, if it’s a private policy) and a dental insurance company. The coverage you receive is based on the terms your employer negotiated with the insurance company, not the dental office. Often, these plans prioritize cost over patient need, meaning many essential services might not be covered.

Understanding Covered and Non-Covered Services

It’s important to know that not all necessary dental services are covered by your insurance. Dental plans typically cover only those services agreed upon in the contract with your employer, which can often exclude procedures that are critical for optimal dental health. We recommend reviewing your plan booklet to understand the limitations and exclusions of your coverage.

Elective and Non-Covered Treatments

Treatments such as cosmetic dentistry, implants, and teeth whitening are often considered elective and not covered by insurance. These services, while potentially life-enhancing, are usually not included in standard insurance contracts.

Maximums, Deductibles, and Waiting Periods

Dental plans often include annual maximums, which cap the amount the insurer will pay within a year. Once this limit is reached, you’ll be responsible for all subsequent costs. Additionally, plans may include deductibles—amounts you pay out-of-pocket before insurance kicks in—and waiting periods, which delay coverage for certain procedures.

Pre-Determination and Authorization

Many insurers require pre-authorization for certain treatments to manage the scope of dentistry services covered. It’s important to note that in most situations, we can begin treatment before authorization is formally granted by your dental insurance company. However, please be aware that pre-authorization is not a guarantee of coverage. Even if authorization is initially approved, there is a possibility that your insurance company might deny payment for the treatment after it is completed. We will provide you with cost estimates upfront to ensure you are fully informed of potential expenses. Should there be any denial at any stage, you will be responsible for covering the costs. Our team is dedicated to supporting you through this process, helping to minimize surprises and clarify your financial responsibilities.

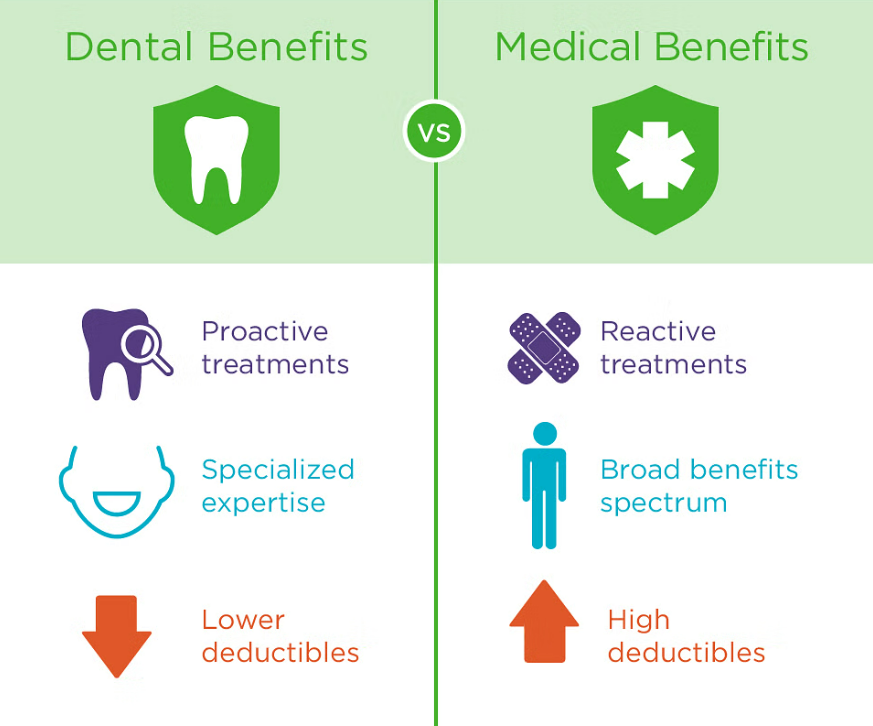

Dental vs. Medical Insurance: Key Differences

Unlike medical insurance, which covers a large portion of high medical costs after deductibles, dental insurance primarily supports preventive care such as cleanings and exams.

However, for more advanced dental procedures, coverage is limited, often leaving patients with significant out-of-pocket expenses. This is due to dental insurance typically having an annual cap (usually between $1,000 to $2,000), beyond which all costs must be borne by the patient.

Thus, dental insurance functions more like a discount plan than it does as an insurance, helping manage predictable dental costs rather than providing comprehensive financial protection.

How Our Office Can Help

Our team is committed to helping you navigate your insurance benefits effectively.

During your initial visit, we will verify your coverage and submit your dental insurance claims to secure the maximum reimbursement to which you are entitled.

However, please understand that while we will diligently pursue payment from your insurance company, there are limits to how long we can wait for their response. If the insurance company fails to provide payment within a reasonable timeframe, you will be responsible for the outstanding balance. At that point, you may choose to seek reimbursement directly from your insurer.

We are here to assist you with the necessary documentation and support to facilitate this process.

Next Steps

We understand that navigating dental insurance can be challenging. While managing insurance claims is not our obligation, we offer our expertise and assistance as a courtesy to our patients.

During your visit, please do not hesitate to ask questions about your insurance benefits. Our team will help clarify what is covered under your plan and assist in submitting claims to maximize your benefits.

However, we encourage you to become familiar with the details of your insurance coverage, as this will empower you to make informed decisions about your dental care.

Should issues arise with insurance payments, we will support you in understanding how to handle them, but ultimately, the responsibility for managing and disputing insurance claims lies with you, the policyholder.

FAQs on Medicaid

Is Medicaid an Insurance

No. Medicaid is a government assistance program that provides healthcare coverage for eligible individuals, but it is not traditional insurance.

At Parkside Dental, we are extremely proud to be one of the few Medicaid providers, ensuring access to quality care for those who qualify. While Medicaid has stringent restrictions on what it covers, that does not mean it cannot provide good treatment options for your needs. Our team is here to guide you through your options under Medicaid and beyond.

Does Medicaid Cover Crowns?

No. In South Dakota, Medicaid does not cover crowns.

However, crowns are still an essential treatment for maintaining your overall oral health, especially when preserving damaged or weakened teeth. If you require a crown, ask us about alternative coverage options or our flexible financing plans to help make this vital treatment accessible.

Does Medicad Cover Dentures?

Yes! Medicaid provides good coverage for dentures, typically allowing replacement every seven years.

However, it’s important to note that dentures alone are not considered the “standard of care” for tooth replacement. For the best long-term prognosis, implants should be considered as a more durable and functional solution.

We offer financing options to make implants more attainable and are happy to discuss how they can enhance your treatment plan.

Can I combine Dental Insurance with Medicaid?

Yes, some individuals can be approved for dual coverage. You can purchase additional dental insurance even if you are covered by Medicaid.

Adding dental insurance can help cover treatments that Medicaid does not, such as crowns, implants, or certain cosmetic procedures. Having supplemental dental insurance gives you access to a broader range of treatments.

However, by state law, you and we are required to submit claims to your dental insurance before submitting to Medicaid. This could result in greater out-of-pocket costs for you on some dental treatments.

If you’re interested in exploring this option, our team is happy to discuss which private dental insurance plans might work best for your needs.